Typical Down Payment On A House

Too often potential home buyers delay purchasing a home because of misinformation about a house down payment. The home down payment is the largest obstacle between homebuyers and completing the purchase. In this post, I will help you better understand down payments, different loan products and their minimum down payment amounts, and how to go about choosing the best down payment for you.

And to keep you excited, I am sharing this right at the top: No, you do not need a 20% down payment to buy a home.

Average Down Payment on a House

Answering what is an average down payment is a difficult question to answer because there are so many other important variables to consider. Instead, home buyers should understand their options and utilize the best path to meet their goals.

Many first time home buyers seek to minimize their down payment. Therefore, FHA and insured conventional loans are popular products for first time homebuyers. On the other hand, someone who is selling and buying a new home (we call this the trade-up) often makes a larger down payment. This is because trade-up buyers often apply all or nearly all of the proceeds of their home sale to their new home purchase.

Asking the typical down payment on a home ignores what really matters which is your needs. Let’s take a look at mortgage types to help you better understand how the loan type affects your minimum home down payment amount.

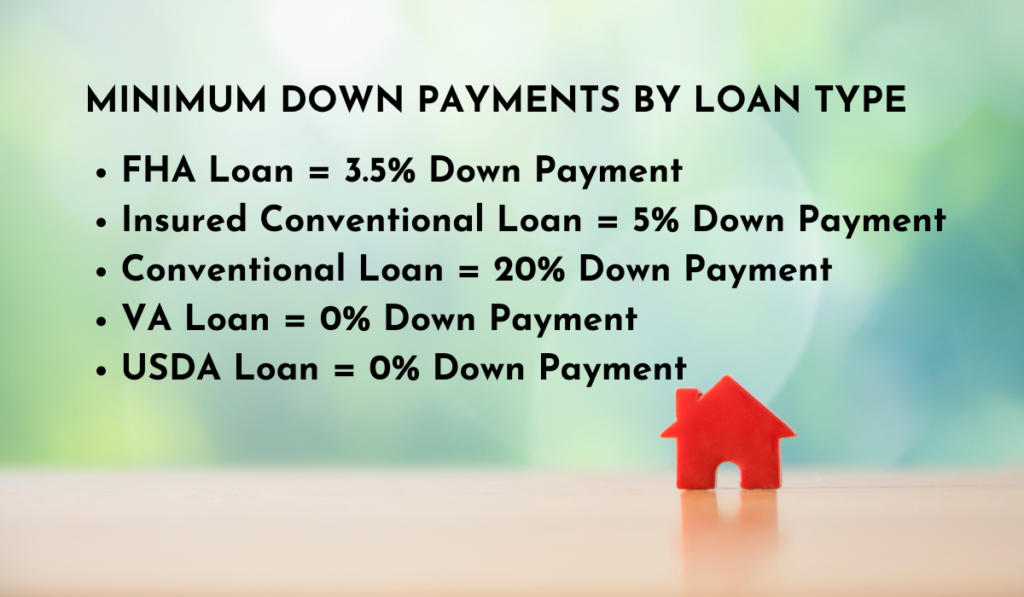

Minimum Down Payment for a House and Mortgage Loan Types

A home buyer’s mortgage down payment requirement is based on the buyer’s loan type. Each loan type has a different minimum down payment. Let’s take a look at each of the common loan types to help you understand the minimum down payment for a house.

Conventional Loan

The down payment minimum for a conventional loan is 20% of the home’s purchase price. In exchange, borrowers using a conventional loan will not have private mortgage insurance.

Insured Conventional Loan

The minimum down payment for an insured conventional loan is 5% of the home’s purchase price. An insured conventional loan has all the same requirements as a conventional loan. The difference is the lower down payment amount and you must get private mortgage insurance. Private mortgage insurance is less expensive than most buyers think. Additionally, private mortgage insurance can be removed at your request once you have a built up 20% equity in the home.

FHA Loan

First, “FHA” is an acronym for Federal Housing Administration. Many people falsely believe the “FH” part has something to do with first time home buyers. That is not true. And, no, you do not need to be a first time home buyer to get an FHA loan. Now, on to the minimum down payment with an FHA loan.

Home buyers using an FHA loan will need a minimum down payment amount of 3.5% of the home’s purchase price.

To help minimize a borrower’s out of pocket expense, a buyer can ask the seller for up to 6% of the home’s purchase price in closing cost credits. However, these credits cannot be applied to the down payment minimum needed.

VA Loan

A VA loan is a loan guaranteed by the United States Department of Veterans Affairs. Qualifying veterans and the surviving spouses of qualifying veterans are eligible for this loan type.

The minimum down payment for a VA loan is 0%. Yes, a home buyer using a VA loan does not have to make a down payment. Another great fact about VA home loans is there is no private mortgage insurance.

USDA Loan

Home buyers using a USDA loan have a 0% down payment. There are special requirements for using a USDA loan, though. The USDA loan program is designed to prop up housing in rural areas and places where wages are generally lower. First, buyers must meet the income requirements; buyers making earning too much cannot use this program. Secondly, the home must be located in a USDA eligible area.

Best Options for First Time Home Buyer Down Payment

The best down payment option for a first time home buyer is the 5% down, insured conventional loan. This is a conventional loan product, so the credit score requirements are a little bit higher. However, the private mortgage insurance with an insured conventional loan often costs less than the private mortgage insurance required with an FHA loan. The insured conventional loan provides the most value while getting you in a home more quickly than saving 20% for a down payment.

The second best option for first time home buyers is an FHA loan. An FHA loan only requires a 3.5% down payment. Also, FHA loans can accommodate a little lower credit scores often as low as 620 and sometimes as low as 580. One drawback to an FHA loan is the private mortgage insurance is usually more expensive compared the rate for the same insurance in an insured conventional loan.

How Much to Save for a Down Payment

Home buyers should save the minimum amount needed for a down payment and complete the purchase. Here’s the thing, it’s all about market conditions.

This is being written in November 2021. Mortgage interest rates are at all-time lows. Housing inventory is a bit scarce, yet there are a lot of buyers out there wanting to buy homes. This is causing home prices to appreciate rapidly. By the time you save more money, the house costs more money. Save up the minimum down payment needed to get you into the home that works for you and the loan product you want to use and pull that trigger.

How Much to Save for a Down Payment on a House?

Buyers should save the minimum amount needed to purchase the home and obtain the loan product which meets their needs. Larger down payments actually do very little to significantly lower a monthly mortgage payment. Take a look at this example which will show you how minimally a larger down payment will affect your monthly payment.

- Home Buyer 1 borrowers $200,000 for 30 years at a 3.75% interest rate. Her monthly payment for principal and interest repayment is $926.00.

- Home Buyer 1 borrowers $201,000 for 30 years at a 3.75% interest rate. His monthly payment for principal and interest repayment is $931.00.

The takeaway here is every $1,000 more in down payment will only lower your house payment by about $5 per month. So that extra $10,000 you want to save, well, that’s only going to lower your house payment about $50 per month. Why? Again, interest rates are incredibly low and the term of the loan is spread out over such a long period of time.

Conclusion

Don’t let buying a home be controlled by an average down payment on a house amount or trying to determine a typical down payment for a home. Instead, focus on yourself and your needs.

Most people buy or sell a home due to a major life event. This could be growing older, a new job, a job loss, a growing family, new marriage, or divorce, or some other major event. It is a shame to see people delay living in the home they want because they are more focused on saving for a larger down payment.

More importantly, there are so many myths out there. No, you do not need a 20% down payment to purchase a home. We have helped people purchase homes and seen them come out of pocket with just several thousand dollars.

About Quadwalls.com

Quadwalls.com is a website started by a real estate broker from Valparaiso, Indiana. The purpose of Quadwalls.com is to help home buyers and home sellers make better decisions and save money when buying or selling a home. Quadwalls.com is the smarter way to real estate.

If you are in need of help buying or selling a home in Northwest Indiana feel free to contact us. We offer an amazing package of services to get your home sold along with the lowest commission rates in Northwest Indiana. Also, buyers who sign up for the Quadwalls Rewards Program receive a 10% home purchase commission rebate.

Quadwalls at its team of connected agents can help you with buying or selling a home anywhere in Northwest Indiana including anywhere in Lake, Porter, LaPorte, Newton, Jasper, Starke, and Pulaski Counties.

Updated: March 29, 2023

Updated: March 29, 2023  819

819  8 min

8 min