The Escrow Account In Real Estate

First and foremost, if you are asking, “What does it mean to be ‘in escrow?’” read my other article that talks about this. If however, you are curious about what is an escrow account, how it works, the benefits, and the escrow fees in Northwest Indiana in particular, you have come to the right place.

An escrow account is like a savings account for property taxes and homeowner’s insurance

Most homeowners who have a mortgage on their home have an escrow account. An escrow account is an account held with your lender, and you as the homeowner / borrower pay into it each month. The money in the account is used to pay your property taxes and homeowner’s insurance. Your lender will send the money owed to the local government taxing authority and to your homeowners insurance company for you.

Your lender is guided on how to calculate what you need to pay into your escrow account each month.

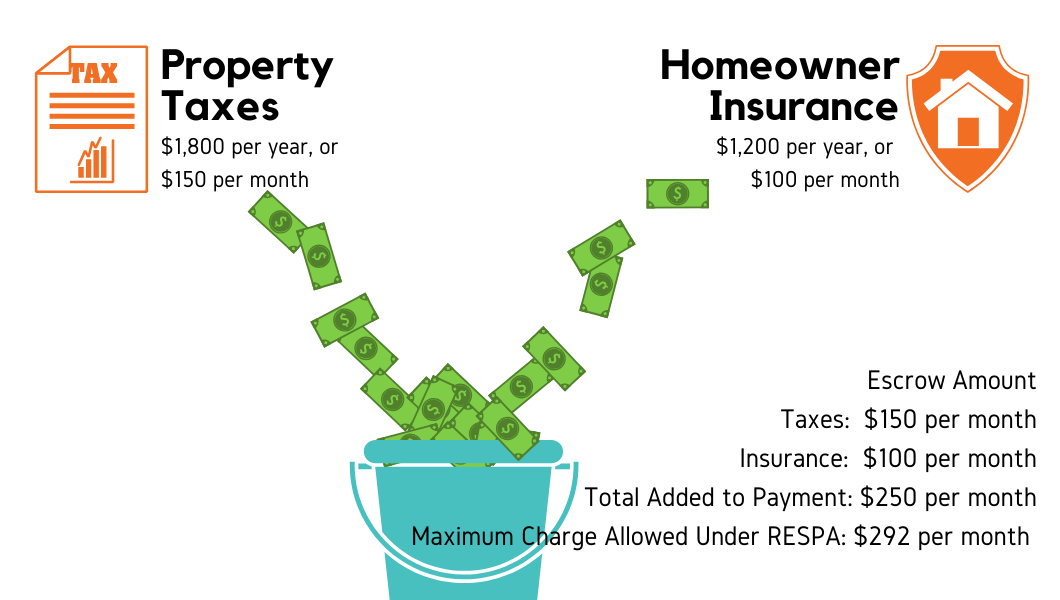

When you purchased your home, your lender was given the homeowner insurance quote for the company you wanted to use. The staff at the lender looked up the taxes and recorded the rate. They then divide this number by 12 to go along with the 12 months of the year. This amount is added on to your principal and interest payment. Lenders can actually charge more, too.

Your lender is allowed to charge an overage, or a cushion. The reason this would happen is to anticipate increases in the cost of insurance or taxes. The Real Estate Settlement Procedures Act (RESPA) recognized this, but it also places limitations on your lender. Your lender is only allowed to keep an amount of one-sixth greater than the actual insurance and taxes due for any year. Sometimes, this cushion gets too big. In that case, your lender will send you a refund to distribute back to you an excessive escrow overage. You can learn more about RESPA here.

This illustration is an example of how an escrow account works and the maximum a lender can collect based on these rates. Keep in mind, every home is unique and has a unique tax rate and homeowner insurance cost. In Northwest Indiana where I practice real estate, this is a good example for the average house in the area.

How does an escrow account benefit me?

A lot of home buyers like having an escrow account. The escrow account helps you because it is a great tool to budget for expenses that will occur.

Failing to pay your property taxes can result in the local government seizing your property. Also, insurance protects your home in the case of a disaster. Both of these have a cost that must be paid each year. Instead of getting a large bill each year which you may or may not be prepared for, the escrow account keeps you paying for these expenses all year long. It is an excellent way to keep you current on the expenses associated with owning a home.

What should I expect at closing when I have an escrow account?

Your real estate agent may be talking about “cash to close.” Cash to close is made up of several parts: down payment, pre-paid interest, title fees, loan origination fees, and impounds.

Impounds, also known as escrow items, are property taxes and homeowners insurance. Most commonly, you will be purchasing your entire first year of homeowner insurance at the closing table. Also, the title company will collect another two to four months of additional premiums. As for taxes, depending on when taxes are next due, the title company will collect two to five months of property taxes. These overages will be sent to your lender to be placed in your escrow account.

What should I expect month to month when I have an escrow account?

Each month you will receive your mortgage statement. Take a look and you will likely notice a line item for escrow items, the property taxes and insurance. This is added to your other costs like principal and interest repayment.

If your taxes or insurance increase, you may see your house payment increase. Alternatively, if these go down, your house payment will be lowered. Again, your lender must stay in compliance with RESPA and can only collect an overage of not greater than one-sixth over the actual amount owed for the year for taxes and homeowners insurance.

Conclusion

An escrow account is used to continuously fund the cost of homeowner insurance and property taxes due on your home. An escrow account is a good thing. It is a great method to keep you inline with a budget and to keep you from having to worry about a huge bill in your mailbox. Also, your lender takes care of sending out the payments which prevents you from getting behind on property taxes or suffering a lapse in your homeowners insurance due to missed payments. If you are selling a home or looking for a home for sale in Northwest Indiana and need any information about escrow account, please, give a call at (219) 309-6098 or reach Quadwalls here on the website and our real estate agents will answer any of your questions.

Updated: March 29, 2023

Updated: March 29, 2023  1506

1506  5 min

5 min